If you’re considering surrendering your LIC policy, you probably wonder how much money you’ll get back. Whether it’s after 3 years, 4 years, or 5 years, the surrender value depends on the plan, premiums paid, and time.

Our LIC Surrender Value Calculator Tool can help you get an instant estimate — no confusion, no complex formulas.

LIC Surrender Value After 5 Years

After 5 years, the surrender value of your LIC policy is usually higher. Typically, you’ll receive:

Around 30% to 50% of the total premiums paid (excluding first-year premium), Plus any bonus, if eligible

Use our calculator to enter your policy details and get an instant estimate.

LIC Surrender Value After 4 Years

At 4 years, surrendering your LIC policy gives you around 30% to 35% of the total premiums paid (excluding the first year). The amount is lower than at 5 years, and some plans might not offer a bonus yet.

You Know Our tool can help you check this by selecting the policy term, type, and amount paid.

LIC Surrender Value After 3 Years

After 3 years, most LIC policies become eligible for surrender. But the amount is basic:

- About 30% of the premiums paid (except the first year)

- No bonus is included yet in most plans

Try our online LIC Surrender Value Calculator — enter your values and instantly see the estimated surrender amount.

🎯 Fun Break: What If LIC Policies Were Superheroes?

Ever wondered what your LIC policy would be like if it were a superhero?

- Endowment Plan? – That’s “Captain Save-a-Lot” 🦸♂️ – always planning for the future and never misses a maturity date.

- Term Plan? – Meet “Risk Rider” 🏍️ – low-cost, high-protection, zooms in when life gets risky.

- Whole Life? – Ah yes, “Forever Saver” 👴 – never retires, just keeps going.

💬 “If your policy had a cape, would it fly to your rescue or just sip chai till maturity?”

Now that you’ve laughed, let’s get back to figuring out your real surrender value 😄

What If I Stop Paying LIC Premium After 3 Years?

If you stop paying after 3 years:

- Your policy may become a paid-up policy

- Or you can surrender and get a lump sum (small) amount

- You won’t get the full value unless you complete the policy term

Use our tool to compare the surrender value vs paid-up value based on your premium history.

How Much Money Will I Get If I Surrender My LIC Policy?

It depends on:

- Policy type (endowment, term, whole life)

- Premiums paid

- Policy term

- Years completed

Our free LIC calculator does the math for you. Just select your policy type, age, sum assured, policy term, and payment mode, and it gives you an estimated surrender value instantly.

How Our Tool Helps You Calculate LIC Surrender Value

Here’s why our calculator is useful:

- Fast Estimates – No manual formula required

- Clear Results – Breakdown of your estimated premium and value

- Mobile-Friendly – Use it anywhere, anytime

- Flexible Inputs – Supports various LIC plans, terms, and ages

Try the LIC Surrender Value Calculator Now 👉

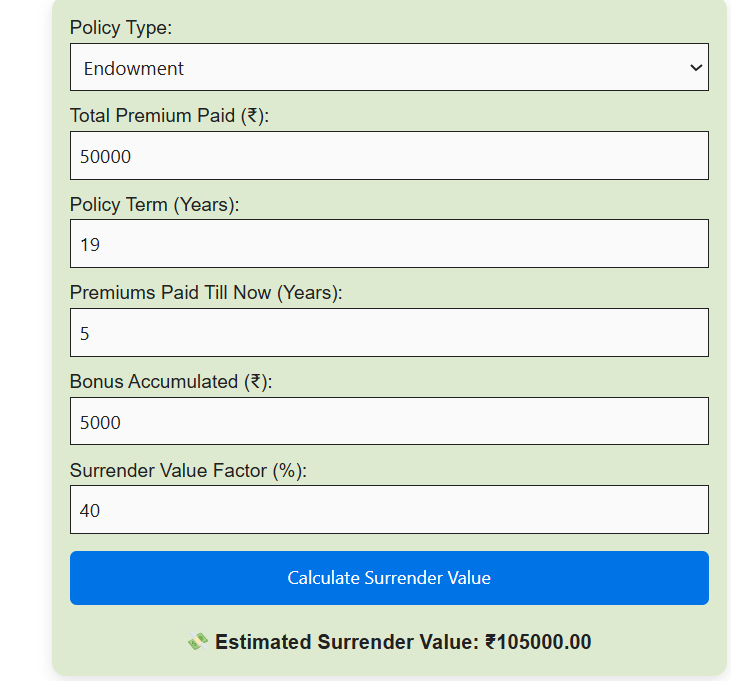

For Example (Screenshot Only),

🧮 Instantly Calculate Your LIC Surrender Value

Want to know how much money you’ll get if you surrender your LIC policy? Use our free LIC Surrender Value Calculator to get an accurate estimate in seconds!

🔗 Use LIC Surrender Value Calculator NowConclusion

Surrendering your LIC policy should be a well-informed decision. Whether you’re checking LIC surrender value after 3, 4, or 5 years, or just want to know how much money you’ll get, our tool makes it simple.

📌 Use our calculator before surrendering — save time, understand value, and plan smarter.

🔚 Wrapping It Up… What’s Next?

Now that you’ve cracked the code on LIC surrender value after 5 years, don’t stop here! 🎓 Whether you’re planning to surrender, switch plans, or just curious about how much you’ll get — our free tool has your back.

👉 Use the LIC Surrender Value Calculator to make smarter money moves today.

🎯 Coming Up Next…

Get ready for more power-packed guides like:

- 🧮 “LIC Surrender Value vs Paid-Up Value: What’s the Difference?”

- 🧠 “5 Things You Must Check Before Surrendering Your LIC Policy”

- 💸 “LIC Jeevan Anand Surrender Value Guide (with Calculator Examples)”

Stay tuned and bookmark mypolicytools.in for expert insights, fun tools, and no-boring-stuff insurance advice!

FAQs — clear, beginner-friendly Questions

1. What happens if we surrender the LIC policy after 5 years?

If you surrender your LIC policy after 5 years, you’ll get a higher surrender value than in earlier years. This includes a portion of your paid premiums and bonuses, if any.

2. How do I calculate my LIC surrender value?

To calculate your surrender value:

Add up all premiums paid (excluding the first year).

Multiply by the surrender value factor (usually 30% to 50%, depending on the policy).

Add any applicable bonuses.

3. What is the surrender value after 5 years?

It’s usually 30% to 50% of total premiums paid (excluding the first year), plus any bonuses. The longer you stay invested, the better your surrender value.

4. How to calculate surrender cost?

The surrender cost is the difference between the total premiums paid and the surrender value received.

For Example: If you paid ₹1,00,000 in total and got ₹40,000 as surrender value, your surrender cost is ₹60,000.,

5. How much money will I get if I surrender my policy

The amount depends on:

Policy type and term

Years completed

Premiums paid

Bonus, if any

Enter your details in our free tool to get an accurate estimate.

6. What is the average surrender fee?

LIC doesn’t charge a direct surrender fee, but you lose a portion of your premiums. On average, you get 30%–50% of the total premiums paid, so the rest is your loss, like an indirect fee.